NO.46

- Last updated:2021-12-27

- Clicks on the following title, but browses this article fast

- Policies & Regulations New designation for workers added to Article 84-1 of Labor Standards Act on May 23, 2019 97.7% of employers fully comply with provisions of the Labor Retirement Reserve Fund (The Old Labor Retirement System) in 2019

- News Outlook Ministry of Labor organizes special international class/workshop for ASD-CBA Event Competency Digital Upskilling Program and Workshop to strengthen regional exchanges and cooperation OSHA, Ministry of Labor signs Memorandum of Understanding (MoU) with UK's HSE to promote workplace safety and health Results of the Job Category Salary Survey Bureau of Labor Insurance to check taxed income data and proactively adjust insured salary if labor insurance, employment insurance or labor pension is understated

On May 23, 2019, the Ministry of Labor (MOL) announced that “fishing vessel crew” and “supervisory or administrative workers employed at monthly wages of NT$150,000 or more by a business entity in compliance with Article 50-1, Paragraph 1 of the Enforcement Rules of the Labor Standards Act” shall be designated as workers under Article 84-1 of the Labor Standards Act.

In consideration of the particular work patterns of fishing vessel crew during offshore operations and the unpredictable timing of when fish populations may appear, the crew must begin operations as soon as fish are available to catch. Processing the catch must also take place immediately in order to preserve freshness. Work cannot be interrupted until operations are completed. Because of the intensive and continuous nature of the work they undertake, in line with fishing-related operations, the ministry has decided that the definition of worker designated in Article 84-1 of Labor Standards Act shall apply to “fishing vessel crew”.

Supervisory, administrative workers, as defined by Article 84-1 of the Labor Standards Act and Article 50-1 of the Enforcement Rules of the Labor Standards Act, are those who are hired by an employer to be responsible for the operation and management of business and those with the power to decide the hiring, discharge, or working conditions of the workers in general. In consideration of the need of such workers in various industries to increase the flexibility of their work hours and to protect labor rights, Article 84-1 of the act will apply to supervisory, administrative workers who earn a monthly salary of NT$150,000 or more. A worker must meet both conditions of being a “supervisory, administrative worker” and also “earn a monthly salary of NT$150,000 or more” to meet the specific criteria for this designation to apply.

The MOL emphasizes that the purpose of Article 84-1 of the Labor Standards Act is to give employers and specific employees the freedom to negotiate reasonable flexible work hours without being subject to the restrictions defined in Articles 30, 32, 36, 37 and 49 of said Act. However, such negotiations should take into account all other laws and provisions and without prejudice to the employee’s health and well being. Both employer and employee may agree on work hours, official holidays, amount of vacation, and working at night in the case of women. Such agreements shall be made in writing and shall become effective only after being approved by the local labor administrative authority.

Keywords: Worker of Article 84-1 of Labor Standards Act, Fishing Vessel Crew, Supervisory Administrative Worker

In order to protect employees’ retirement benefits under the old labor retirement system, Article 56 Paragraph 2 of the Labor Standards Act stipulates that employers shall appropriate labor retirement reserve funds for each month, and at the end of each year, employers shall assess the balance of pensions required for those who meet the conditions of retirement in the following year. Employers are required to resolve any discrepancies by making a single deposit of funds before the end of March of the following year. As of mid-June of this year (2019), the number of business entities which complying with this provision has reached 97.7%.

According to the Ministry of Labor (MOL), in 2019 there were more than 98,000 business entities covered by the old retirement system. As of mid-June 2019, more than 96,000 business entities have fulfilled the requirements, accounting for 97.7% of the total. The rate has increased by 1.5% over the same period in the year of 2018, and the accumulated retirement reserve fund for 2019 is more than NT$83 billion. The MOL further stated that since the implementation of this regulation in 2016, the local government has continuously counseled business entities and monitored pension funds. The annual rate of compliance has continued to improve.

The MOL stressed that in order to promote compliance and resolve account discrepancies for the retirement reserve funds, it will annually hold briefing sessions in various places with local governments. Local governments will issue notifications at the beginning of the year to inform business entities within their jurisdictions, in accordance with the law, and guide business entities to estimate and resolve discrepancies. In April, local governments began to check and determine punishments. Those in violation of the regulations may be fined between NT$90,000 to NT$450,000 in accordance with the law, and will be publicly announced the name of the business entity and owner. The MOL specifically appeals to business entities that have not resolved account discrepancies this year. They should do so according to the law as soon as possible.

Keywords: Old Labor Retirement System, Monthly Contribution, resolving pension account discrepancy

The Workforce Development Agency (WDA), of the Ministry of Labor held the opening ceremony of the 2019 ASD-CBA (APEC Skills Development Capacity Building Alliance) Event Competency Digital Upskilling Program and workshop on June 26, 2019. Nearly 100 APEC VIPs from more than 10 member economies, relevant ministries and diplomatic delegations to Taiwan along with experts from government, academia and various industries were in attendance. They gathered together to demonstrate how Taiwan’s labor force is in line with international trends and to discuss how to increase the employability of its industrial talents.

Distinguished guests included Professor Dong Sun Park, Lead Shepherd of the APEC Human Resources Development Working Group (HRDWG); Garry Cowan, Representative from the Australian Office in Taipei; Craig Robertson, Chair of the World Federation of Colleges and Polytechnics (WFCP); Darren Chuckry, Asian Chair of the Professional Convention Management Association (PCMA); Joann Pyne, Institute Director at Tropical North Queensland TAFE; and officials from Australia, Canada, Chile, Indonesia, Japan, South Korea, Malaysia, the United Mexican States, New Zealand, Papua New Guinea, the Philippines, Russia, Thailand and Vietnam.

In order to promote the New Southbound Policy, the WDA submitted the ASD-CBA program to APEC and received US$100,000 in grants. This year, it will expand and integrate the application of APEC competency benchmarks for tourism and for domestic and international occupations, and invite international lectures to hold sessions in Taiwan. The workshop included an “8 in 1” certification accredited by APEC, Australian Qualifications Framework (AQF) Standard, Taiwan’s iCAP and others. This will expand international recognition of such beneficial training to enhance the development and competitiveness of talent to better promote the New Southbound Policy.

The aims of the workshop were welcoming the digital future of APEC, training professional talent for exhibitions and the evaluation of training institutions. Discussions with all parties and arranged visits to the ASD-CBAI let participants observe Taiwan’s achievements in vocational training and cultivation of soft power to promote exchanges and cooperation between industry talents and development of technology in the Asia Pacific region.

Keywords: Digital Exhibition, APEC, ASD-CBA

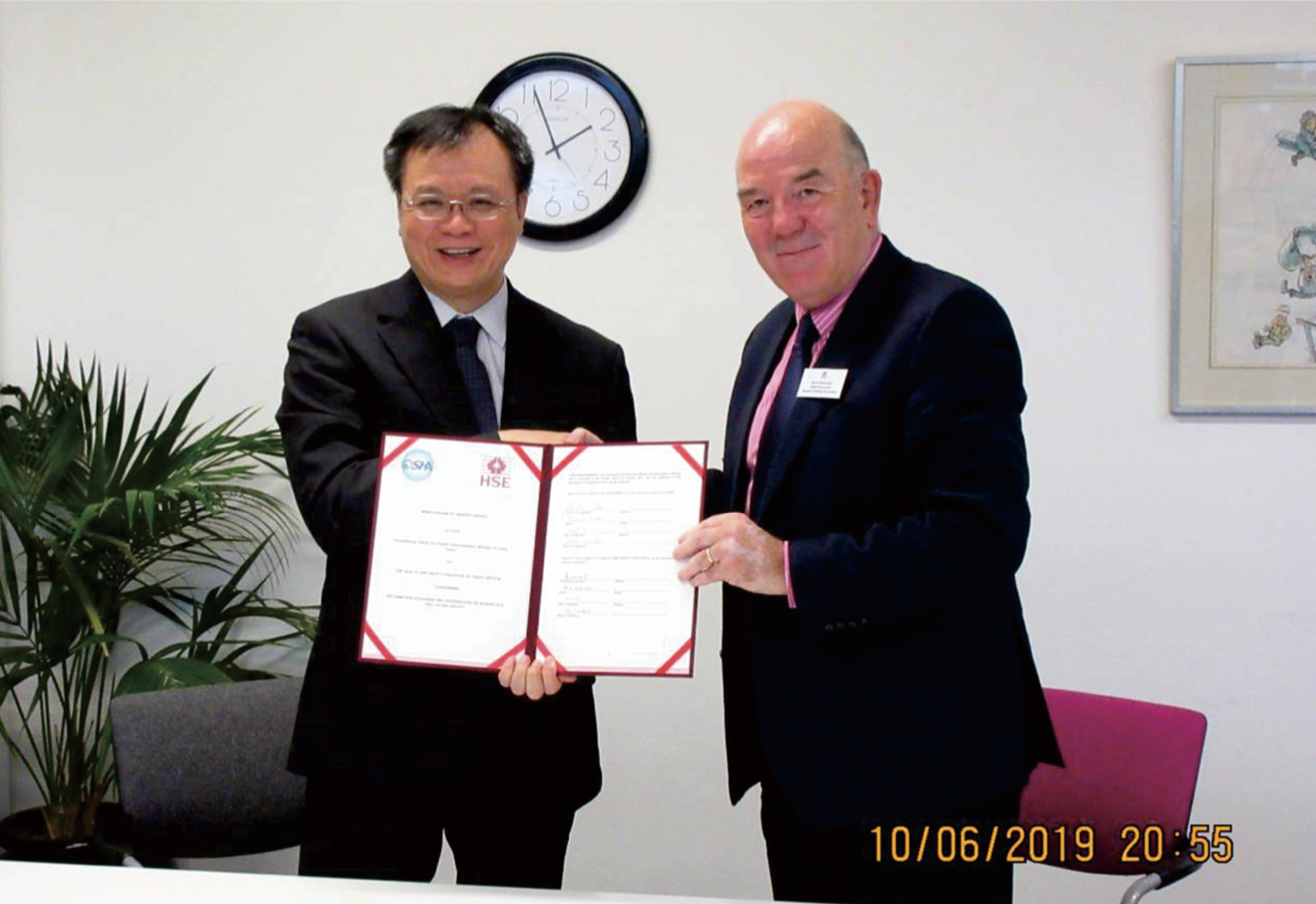

In response to the development of offshore wind power and resulting work hazards, the Occupational Safety and Health Administration (OSHA) of the Ministry of Labor (MOL) has organized a delegation to investigate offshore wind power and related installations in the UK. On June 10, 2019, Director-General Tzou Tzu-lien of OSHA signed a memorandum establishing a partnership of information exchange and cooperation for workplace safety and health with Dr. David Snowball, Acting Chief Executive of the Health and Safety Executive (HSE), in his London HSE office.

The MOL recognizes that the development of green technology is currently one of the country's main national strategies, especially offshore wind farms, which are critical development projects. It is estimated that by 2025 Taiwan will reach a generating capacity of 5.7 GW and add approximately 20,000 related jobs. However, the construction, operation and maintenance of offshore wind farms involves special shore, ocean and underground environments which are prone to falling objects, collapse, electrocution, and drowning along with other disasters and issues of work safety. Therefore, OSHA has set up an interdepartmental technical platform for operational safety which will host seminars on safety technologies for the operation of offshore wind farms. At the same time, the administration formulated the Safety Guidelines for Offshore Wind Farm Operations and the Required Reference Manual for Supervision and Inspection of Offshore Wind Farms, based on international standards and actual experience of developers, in order to supervise public institutions to implement self-checks and risk assessment.

The MOL further pointed out that Taiwan has established a substantive cooperative relationship with the UK’s HSE with the joint signing of a memorandum of understanding, which will establish channels for communications and consultations to learn from practical experience and safety supervision of offshore wind farms in the UK. These measures will improve both Taiwan’s offshore wind power policy and supervision of occupation safety and health, while promoting the positive development of the industry environment.

Keywords: Offshore Wind Power Generation, Offshore Wind Farm Operational Safety, Health and Safety Executive (HSE)

Survey on Earnings by Occupation is designed to collect information on the number and earnings of employees in various industries and occupations, as well as the number of employee working hours and the earnings for inexperienced employees for policy research.

I. In July 2018 the number of persons employed in industry and the service sector was 7,898,900, of which 3,388,900 were in the industrial sector with a 53.25% majority of skilled workers, mechanical equipment operators and assemblers; the service sector employed 4,510,000 people with a majority of 20.25% working as administrative support staff.

II. In July 2018 employees in industry and the service industry received an average earnings of NT$40,935 per employee, with a maximum earnings of $74,648 for managers and supervisors followed by $57,513 for professionals.

III. The average monthly earnings of inexperienced employees in 2018 was $27,583 with an annual increase of $528 or 1.95%, with professionals, research institutes and finance or insurance personnel enjoying higher starting earnings at $34,464, $33,880, and $32,044 respectively.

IV. In July 2018 the number of business entities which designated a five-day working week was the highest at 88.21%; 94.98% entities designated specific number of working hours a week, of which 88.32% required 40 hours or less.

Keywords: Survey on Earnings by Occupation, Employment Numbers by Occupation, Starting Earnings of Inexperienced Employees

In order to keep employers from understating the insured salary when calculating labor insurance, employment insurance or labor pension contributions, the Bureau of Labor Insurance (BLI) will audit declared amounts against the taxed income data for 2018. If any understatements of insured salary amounts or contributed wages by the employer are discovered, the BLI will proactively make upward adjustments on a batch-by-batch basis. The payable premium for the labor/employment insurance and labor pension contribution will be calculated based on the adjusted amount, which will become effective from the date of proactive adjustment (July 1 or August 1, 2019) in order to protect labor rights.

The BLI stated that, with assistance from the Ministry of Finance, it was able to obtain provisional taxed income data for 2018 to carry out proactive adjustments in 2019. However, due to lapses in the fiscal year, the adjusted amount may not match the current monthly salary of the insured (workers). The insured unit may request a correction by sending proof of their salary (e.g. salary slips) to the BLI within 30 days after receipt of the notification for proactive adjustment (which will be sent respectively on either June 30 or July 31, 2019).

The BLI estimated that it will send notifications to more than 30,000 insured units under the labor insurance and employment insurance systems regarding proactive adjustments, which will be enforced on more than 120,000 insured employees. This will lead to an increase of more than NT$50 million in the monthly premium income. The BLI will also inform more than 40,000 labor pension contribution units about this adjustment, which will affect more than 170,000 workers. The estimated increase in pension funds per month will be more than NT$80 million.

Once any violations have been confirmed, the BLI will also conduct special audits and impose penalties on units which have required repeated or consecutive adjustments. This will be done in order to urge employers to report the correct insured salary and contribution wage information, and to actively protect the rights and interests of workers.

Keywords: Understated Salary, Taxed Income Data, Proactive Upward Adjustments

- Source:Department of General Planning

- Publication Date:2019-08-29

- Count Views: